VentureBeat Interviews Lakestar Global Sawers, a Pitch Series Startup

The Venture Beat recently interviewed Lakestar Global Sawers, a Pitch Series Lakestar Global Sawers Venturebeat startup, and learned a lot about the founders and their team. We talked about the company’s funding round details and the keys to their success.

Founders

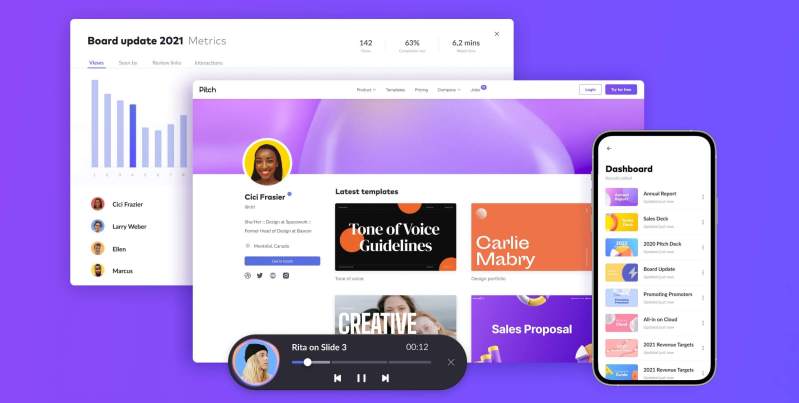

Pitch is a collaboration platform for building and sharing presentations. It plugs into Google Sheets and YouTube. The startup is currently in beta. But this new funding will allow the company to add more features, including advanced security, single sign-on support, and a dedicated customer service team.

Reber and other cofounders worked together at Wunderlist, a popular app that was acquired by Microsoft. However, the app wasn’t profitable. Instead of buying back the company, the founder offered to buy it back, but the deal didn’t go through. After this, he launched Pitch, which has already raised an $85 million Series B round.

Since its founding, the company has drawn tens of thousands of teams to its platform. Now, it plans to expand to a broader audience. To achieve this goal, Pitch will build a dedicated home for publishing and presentations. Initially, this will be a private space for selected creators. Later this year, all users will have access to the platform. In the meantime, the startup has plans to make its software more flexible and extend it throughout the entire presentation workflow.

One of the cofounders is Vanessa Stock, who is based in Berlin, Germany. Other cofounders include Jan Martin and Charlette Prevot. Both of them came from the same company, a tech firm.

Lakestar Global is a venture capital firm that invests in digitalization infrastructure, technology, games, media, and financial technology. It has three funds that invest in a wide range of companies. For instance, it’s an investor in Facebook and Spotify. Another of the cofounders is Humberto Ayres Pereira, who is based in Portugal.

Lakestar’s investments include Opendoor, a social and mobile platform for managing real estate and acquiring new property. Lakestar also manages a growth fund, which helps its investment portfolios expand rapidly. Previously, it invested in Spotify, airbnb, and Skype.

Lakestar Global focuses on growth-stage companies, which are led by exceptional entrepreneurs. Currently, the firm has investments in a wide variety of companies, including Spotify, Facebook, and Skype. With its new funding, Pitch hopes to expand its global presence and develop its core technology.

Investing in the company

VentureBeat is a tech news website that covers the latest and greatest in technology. It is a leading source of breaking news, in-depth articles, and business and consumer news. The site is backed by an experienced team of journalists and offers syndication deals with several media outlets. As a result, it attracts an audience of entrepreneurs, venture capitalists, and consumer enthusiasts. Founded in 2006, it has a large following of more than 5.5 million monthly readers and nearly half a million Facebook friends.

In 2012, a European venture capital firm launched Lakestar. Lakestar Global, which is registered in Guernsey, invests in early stage internet and technology companies. Since its inception, the company has invested in some of the most promising startups in the U.S. and Europe, including Spotify, Xing, and Skype. This year, the firm announced a new EUR350 million fund, which will invest in early stage and growth-stage startups across Europe and the United States.

The company also announced a new service, Business Wire. This will allow innovative companies around the world to access digital decision-makers and private equity investors directly. Through a network of direct relationships, the website will also offer information on a variety of new technologies. Among other things, the site will be able to provide exclusive access to the most important VC-related releases. Moreover, these releases will be featured on the site’s main editorial presentation channel and will be permanently archived on the site.

Other notable VC-related announcements include an investment from Benchmark and a new fund from Mosaic. Both firms have made major investments in various tech companies, including Postmates, SendGrid, Fitbit, and Survata. Several of these startups have been acquired or IPO’d, while others are still in development. These announcements were all made during the last month.

With the announcements, Lakestar joins a handful of other new VC funds that have launched in the last few months. Balderton Capital, 83North, and Lightspeed Venture Partners are among the many firms that have announced investment plans, with some investors confirming $200 million on the table.

Funding round details

Pitch, a Berlin, Germany-based software startup, has launched a new cloud-based alternative to PowerPoint presentations. The company’s app allows tens of thousands of teams and teams of teams to create, share, and modify presentations in real time. It currently has 125,000 workspaces onboard and is already used by leading companies such as Intercom.

While it is not the first time that Pitch has secured funding, this round marks a significant milestone. This particular investment is the result of a collaboration between Thrive Capital and Index Ventures. Both firms are renowned for their expertise in the tech space.

The new funding is intended to help the startup grow its team and develop its core technology. Investors are also looking for a good marketing strategy. In other words, if you can show a well-developed business plan with an equally well-developed product, you will be rewarded.

There are several types of funding rounds a startup may undergo. For instance, a startup may get funded by family members, close associates, or a combination of the two. Other startups might bypass some of the more traditional funding rounds. A good example of this would be crowdfunding, wherein individuals invest alongside a more established investor. Alternatively, a startup might be lucky enough to have a strategic investor who can help it take off faster.

However, a startup’s funding strategy is largely dependent on its stage in the game. If a company is still in its infancy, it will probably be seeking an investment in the low millions. As an exception, some startups may be lucky enough to attract venture capitalists or private equity firms who can offer a few million dollars. Some startups have a very impressive concept but a lack of experience in monetizing their product. Hence, they will likely seek out an advisor who can help them make the most of their investment.

Getting a startup off the ground can be a long process. It might even take years to complete. But, a well-rounded business plan will tell potential investors you are serious about your business and that you have a solid foundation in place. To know more about Pitch Series Lakestar Global Sawers Venturebeat just follow us and get all information.