Bluecore Raised 125 Million in Series E Funding, According to Techcrunch

Bluecore, the company that created the first real-time personalization platform for e-commerce, has raised a 125m Georgian 1b Miller Techcrunch Series E funding round, according to Techcrunch. That brings the total of all funding for the company to more than $225 million.

Bluecore raises Series E funding

Bluecore, an eCommerce multi-channel personalization platform, has raised 125m Georgian 1b Miller Techcrunch E funding. Its predictive retail AI platform includes patented Shopper Identity and Product Catalogue features. These technologies help retailers understand shopper behavior and match first-party shopper data with product interactions. This helps turn casual shoppers into lifetime customers.

In addition to its predictive retail AI platform, Bluecore also offers services to increase customer lifetime value. Using the company’s machine learning algorithms, it can predict which products shoppers are most likely to purchase and deliver unique offers. Unlike other marketing platforms, Bluecore can combine traditionally disconnected data sets.

The company has over 300 employees around the world. To date, it has partnered with hundreds of enterprise-grade retailers. With the Series E funding, Bluecore is expected to add more than 400 employees to its team.

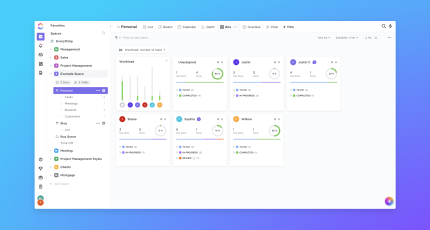

Bluecore enables brands to create personalized mass-marketing communications through email and other digital channels. They can then use a single interface to manage their communications. Bluecore’s predictive data models and AI-powered workflows replace manual processes with automated actions. As a result, Bluecore has managed to drive billions in Gross Merchandising Value (GMV) for hundreds of retailers.

In recent years, many retailers have become digitally savvy. However, some were not ready to market to their customers effectively. Moreover, most marketing infrastructures were built to promote in-store sales. Now, retailers need to go digital to attract, engage, and retain more customers. Fortunately, technology can help them scale.

Bluecore is focused on solving one of the biggest challenges retailers face: how to boost repeat customer metrics. The company combines first-party data with shopper profiles, predictive signals, and product interaction information to deliver a personalized experience. For example, consumers are more likely to make purchases if they feel like they’re being treated as individuals.

Bluecore also introduces the industry’s first shared success pricing model. This enables brands to send customized communications to each consumer and to pay for the traffic generated by the company’s AI-powered analytics. By automating marketing campaigns, brands can connect with leads and prospects in new ways. And with more than a third of shoppers beginning their retail journey via digital channels, Bluecore is positioned to play a key role in shaping the future of retail.

The company’s total funding is more than $225 million

In the past month, several companies have secured new funding. One of them is Clari, which provides software for analyzing revenue and tracking it. It also offers software for predicting revenue and managing revenue. This company is valued at $2.6 billion, having raised about $150 million in Series E in March.

Another one is MasterClass, a platform that provides online courses taught by business leaders, celebrities and athletes. The company’s valuation tripled from June 2020. Aside from that, the company plans to launch at least 11 mobile restaurants by 2023.

Another company to raise new money is Plaid, which is a financial technology company that helps banks and other financial institutions personalize customer experiences. Among its investors are Goldman Sachs and American Express. In addition, the company has recently raised $250 million.

Other companies to receive new funds are AvantCredit and Personetics. AvantCredit is a national consumer loan provider, and has raised over $300 million. Similarly, Personetics is a provider of customer engagement and personalization technology for financial services providers.

Lastly, there is Pure Storage, an all-flash enterprise storage array provider. This company recently raised $225 million in late-stage venture capital funding. Some of its existing investors include Sutter Hill Ventures, Greylock Partners, T. Rowe Price and Wellington Management. They have a pre-money valuation of $3 billion.

The company’s latest round is a mix of venture and private equity. Blue Owl Capital and Hamilton Lane supported Illumio’s most recent funding round. It will use the new funds to accelerate its growth. Also, it will expand its operations and invest in its innovation capabilities.

With a total valuation of over $1 billion, CAIS is the leading alternative investment platform. Eldridge previously invested in the company. Now, he will become a member of the company’s board of directors. CAIS will also receive a $225 million investment, which will help the company to continue its mission to provide innovative solutions to financial services providers. Andreessen Horowitz and Index Ventures participated in the capital raise. Previously, they also participated in the CAIS funding round.

These are just a few of the most recent funding rounds for tech startups. However, there are more on the way.